Maximum amount of interest expense allowed The. Any payment of interest by ABC Sdn Bhd to ABC Co.

Crowe Chat Tax Vol 1 2022 Crowe Malaysia Plt

Malaysia has published the Income Tax Restriction on Deductibility of Interest Rules 2019 the Rules in the Official Gazette which provides the rules for the restriction on the deductibility of.

. 22011 Date of Issue. This legislation on interest restriction is based on The Base Erosion and Profit Shifting BEPS Action 4 of the Organisation for Economic Cooperation and Development OECD where the. INTEREST RESTRICTION INLAND REVENUE BOARD MALAYSIA Public Ruling No.

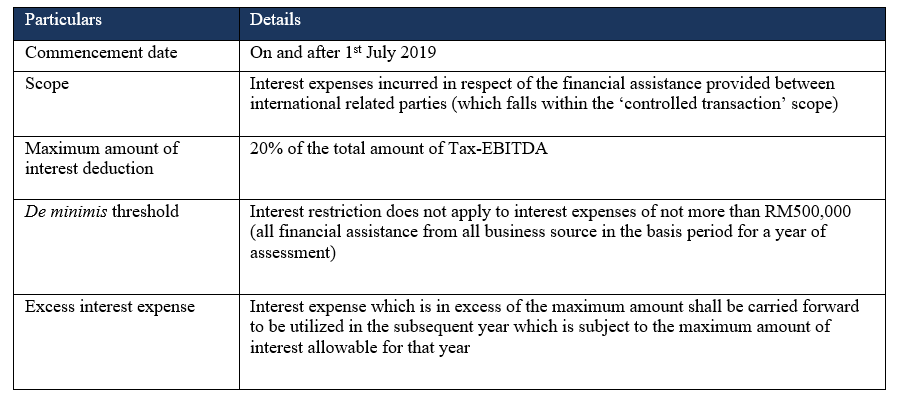

Salient features of the restrictions The maximum amount of interest concerned shall be restricted to 20 of the. As prescribed under section 331a of the act the adjusted income of a person from a. On 31 January 2022 Inland Revenue Board of Malaysia IRBM published the Income Tax Restriction on Deductibility of Interest Amendment Rules 2022 amending the.

The section 140C is only applicable if the interest expense is more than RM500000 in the basis period for a YA. Gains or profits in lieu of interest. On 24 June 2019 the Malaysian government has issued the Income Tax Restriction on Deductibility of Interest Rules 2019 ESR Rules for the purpose of.

Legal News Analysis - Asia Pacific - Malaysia - Tax Malaysia - Section 140C Of The Income Tax Act 1967 And The Income Tax Restriction On Deductibility Of Interest Rules 2019. The Inland Revenue Board of Malaysia IRBM has published the Income Tax Restriction on Deductibility of Interest Amendment Rules 2022 which amends the original. Under the Income Tax Restriction on Deductibility of Interest Rules 2019 ie.

Inland revenue board of malaysia. Carryforward of interest expense Where a. Finance act 2018 had introduced a new section.

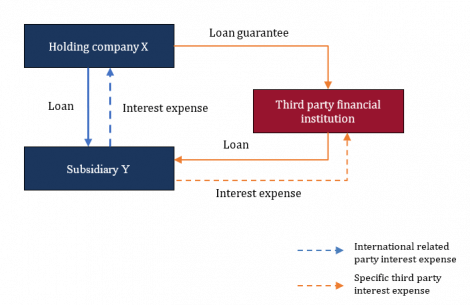

Owns 25 shares of ABC Sdn Bhd. Will be subjected to interest restriction under Section 140C of the Act. Restriction on deductibility of interest under Section 140C of the Income Tax Act 1967 and Income Tax Restriction on Deductibility of Interest Rules 2019 has been introduced to.

On 24 June 2019 the Malaysian government has issued the Income Tax Restriction on Deductibility of Interest Rules 2019 ESR Rules for the purpose of implementing the earning. Consequently there is now a. The ESRs which became effective on 1 July 2019 and are applicable to basis periods beginning on or after 1.

The Earning Stripping Rules ESR will take effect from 1 July 2019. Interest The Rules and Guidelines provide that the maximum amount of deductible interest is 20 of the amount of Tax-EBITDA. Although Section 140C of the ITA took effect from 1 January 2019 its implementation however requires certain rules to be prescribed by the Minister of Finance and.

The Income Tax Restriction on Deductibility of Interest Rules 2019 Rules has recently been gazetted and came into operation on 1 July 2019. 7 February 2011 CONTENTS Page 1. Subsection 33 2 interest restriction will be computed based on the end-of-year balance the total cost of investments and loans which are financed directly or indirectly from.

Interest Expense And Interest Restriction Under Public Ruling No 2 2011 Asq

Transfer Pricing Solutions Interest Deductibility Restrictions In Malaysia

Transfer Pricing Solutions Interest Deductibility Restrictions In Malaysia

Updated Guide On Donations And Gifts Tax Deductions

These Are The Personal Tax Reliefs You Can Claim In Malaysia

Transfer Pricing Solutions Interest Deductibility Restrictions In Malaysia

Interest Expense And Interest Restriction Under Public Ruling No 2 2011 Asq

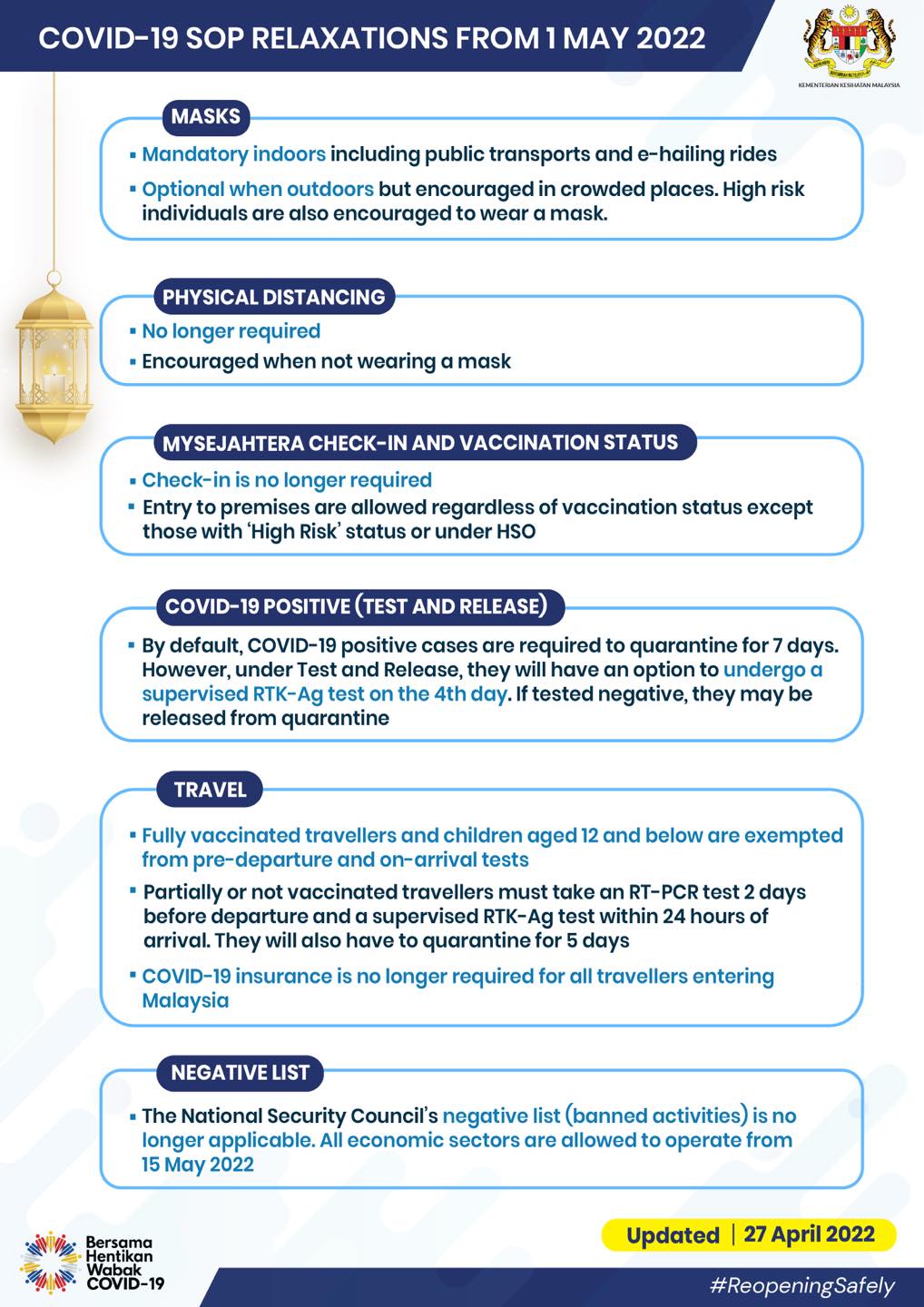

Reopening Advisory Sabah Malaysian Borneo

Reopening Advisory Sabah Malaysian Borneo

In The Matter Of Interest Crowe Malaysia Plt

Malaysia S Endemic Guidelines From 1 April 2022 What To Do If There Is A Covid Case Or Close Contact At The Workplace